Anúncios

Unlike traditional credit cards, the Apple Card offers instant access via the Wallet app, real-time spending insights, and no hidden fees, making it a user-friendly financial tool for everyday purchases.

Disclaimer: You will be redirected to the official website.

Benefits of Apple Card

- 3% Daily Cash Back on purchases from Apple, select merchants, and specific retailers

- 2% Daily Cash Back on purchases made with Apple Pay

- 1% Daily Cash Back on all other purchases made with the physical titanium card

- No annual fees, foreign transaction fees, or late fees

- Seamless integration with the Wallet app for real-time spending insights

- Advanced security features, including Face ID, Touch ID, and location-based fraud protection

Watch the Video

Pros

- No hidden fees – no annual, late, or foreign transaction fees

- Instant approval and access through the Wallet app on your iPhone

- Daily Cash Back with immediate availability for use

- Advanced security features to prevent fraud and unauthorized transactions

- Simple and intuitive money management through the Wallet app

Cons

- Requires an iPhone to apply and manage the card

- Limited 3% cashback categories – only at select merchants

- Physical titanium card earns only 1% cashback

about the card

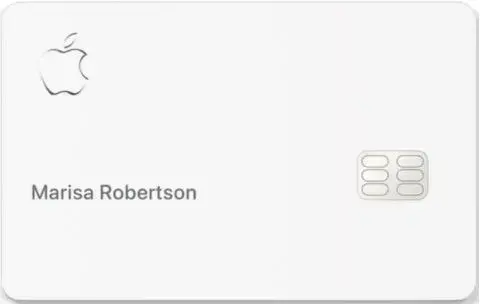

The Apple Card is a digital-first credit card that works best when used with an iPhone and Apple Pay. Designed in partnership with Goldman Sachs and Mastercard, it focuses on transparency, security, and daily cashback rewards.

One of the standout features is Daily Cash Back, which allows users to earn up to 3% cashback instantly on purchases. Unlike traditional credit cards that require waiting until the end of a billing cycle to receive rewards, the Apple Card credits cashback to your Apple Cash balance immediately after each transaction, allowing for instant spending or transfer to a bank account.

The no fees policy sets this card apart. With no annual fees, foreign transaction fees, late fees, or over-limit charges, it ensures a stress-free credit card experience. Even though there is an APR range based on creditworthiness, Apple provides clear payment options in the Wallet app to help users manage their balances responsibly.

Security is another major advantage of the Apple Card. With Face ID, Touch ID, and real-time fraud monitoring, it ensures your transactions are secure. The physical titanium card, which can be used where Apple Pay is not accepted, contains no visible card number, CVV, or expiration date, reducing the risk of fraud.

The Apple Card is ideal for iPhone users who prefer cashback rewards, simple money management, and strong security features in a credit card.

How to Apply for the apple Card

- Open the Wallet app on your iPhone

- Tap the “+” button and select Apple Card

- Fill in your personal details (name, date of birth, Social Security number, and income)

- Review the offered terms, including your credit limit and APR

- Accept the offer and start using the card immediately with Apple Pay

- Receive the optional physical titanium card in the mail within 7-10 business days

Disclaimer: You will be redirected to the official website.

best card for apple pay and seamless cashback rewards

The Apple Card is the best credit card for Apple Pay users, offering fast cashback rewards and simple money management through the Wallet app.

Top Benefits of Apple Card

- 3% Daily Cash Back on Apple purchases and select retailers

- 2% Daily Cash Back on all Apple Pay purchases

- 1% Daily Cash Back on physical card transactions

With no fees and seamless Apple Pay integration, the Apple Card is a top-tier choice for maximizing cashback rewards on everyday spending.

Benefits Breakdown

| Feature | Details |

|---|---|

| Rewards Rate | 3% cashback on Apple purchases and select merchants, 2% on Apple Pay, 1% on physical card transactions |

| Annual Fee | $0 |

| Foreign Transaction Fees | None |

| Security Features | Face ID, Touch ID, fraud protection, and location-based security |

| Daily Cash Back | Instant cashback available for use or transfer |

| Physical Card | Titanium card with no visible card number for added security |

NO FOREIGN TRANSACTION FEES FOR INTERNATIONAL USE

Frequent travelers can use the Apple Card abroad without worrying about extra fees. Since many credit cards charge up to 3% for foreign transactions, the Apple Card provides a cost-effective way to make international purchases.

How to Improve Your Credit Score to Get Approved for the aPPLE credit CARd

The Apple Card requires a fair to excellent credit score (typically 660+). If you’re looking to increase your approval chances, follow these steps:

- Pay bills on time to maintain a strong payment history

- Keep credit utilization below 30% to demonstrate responsible credit management

- Check your credit report for errors and dispute inaccuracies

- Avoid multiple new credit applications within a short period

- Establish a longer credit history by keeping older accounts open

Taking these steps can help increase your approval odds and unlock better credit offers in the future.

FINAL CONSIDERATIONS

The Apple Card is an excellent option for iPhone users who want a straightforward and rewarding credit card experience. With Daily Cash Back, no hidden fees, and seamless Apple Pay integration, it is designed to make credit card usage easier and more transparent.

For those who frequently use Apple Pay, the 2% cashback on all digital transactions ensures you’re maximizing rewards on everyday purchases. Additionally, the 3% cashback on Apple purchases and select merchants adds even more value for Apple loyalists.

While the Apple Card lacks traditional travel perks like airport lounge access or travel insurance, it compensates with zero foreign transaction fees and a secure payment experience. The card’s real-time spending insights, security features, and digital-first design make it one of the most user-friendly credit cards available.

If you value simplicity, transparency, and quick cashback rewards, the Apple Card is an excellent choice.