Anúncios

With no annual fee, a 0% introductory APR on balance transfers, and a competitive ongoing APR, this card is an excellent tool for managing debt and keeping interest costs low.

Disclaimer: You will be redirected to the official website.

Benefits of BankAmericard®

- 0% introductory APR for 18 billing cycles on balance transfers made within the first 60 days

- No annual fee, making it a cost-effective choice for budget-conscious cardholders

- Competitive ongoing APR, helping to minimize interest charges for those carrying a balance

- No penalty APR, meaning your rate won’t increase due to a late payment

- FICO® Score access, allowing you to monitor your credit score for free

- $0 Fraud Liability Guarantee, ensuring you’re protected from unauthorized transactions

Watch the Video

Pros

- Long 0% intro APR period for balance transfers and purchases

- No annual fee, reducing the cost of card ownership

- No penalty APR, protecting you from rate hikes due to late payments

- FICO® Score access, helping you monitor your credit health

- Ideal for balance transfers, with one of the longest introductory APR periods available

Cons

- No rewards program, making it less attractive for those who want cashback or points

- Requires good to excellent credit, limiting approval for those with lower scores

- Balance transfer fee applies, making it important to calculate if a transfer is worth it

about the card

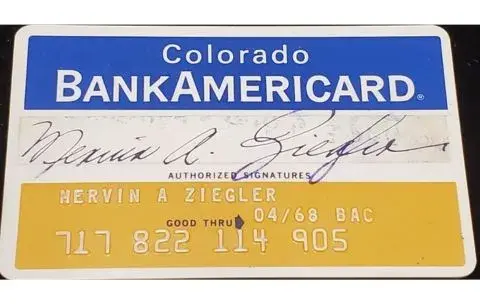

The BankAmericard® Credit Card is a top choice for individuals looking to manage debt effectively. While many credit cards focus on offering cashback or travel rewards, the BankAmericard® is designed for those who prioritize low interest rates and financial flexibility.

One of its most attractive features is the 0% introductory APR for 18 billing cycles on balance transfers and purchases. This gives cardholders an extended period to pay down existing debt without accruing interest. After the intro period, the regular APR remains competitive, making it a solid long-term option for those who occasionally carry a balance.

The BankAmericard® is particularly useful for balance transfers, allowing cardholders to consolidate high-interest debt from other credit cards. With no annual fee and no penalty APR, it’s a low-risk choice for responsible credit management.

This card is best suited for individuals looking for a simple, low-cost way to manage their finances. If you’re focused on paying down debt and minimizing interest expenses, the BankAmericard® is a strong contender.

How to Apply for the bankamericard®

- Visit the Bank of America website and navigate to the BankAmericard® application page

- Click “Apply Now” to start your online application

- Enter personal details, including your name, address, and Social Security number

- Provide employment and income information, ensuring your financial details are accurate

- Review the terms and conditions, confirming you meet the credit requirements

- Submit your application, and wait for an instant decision or further review

- If approved, you’ll receive your card within 7-10 business days

Disclaimer: You will be redirected to the official website.

best card for low interest and balance transfers

The BankAmericard® Credit Card is one of the best options for balance transfers and low interest rates. Its extended 0% introductory APR period makes it ideal for consolidating and paying off existing credit card debt.

Top Benefits for Low-Interest and Balance Transfers

- 0% intro APR for 18 billing cycles on balance transfers and purchases

- No penalty APR, ensuring rate stability even if you make a late payment

- No annual fee, making it a cost-effective credit option

- $0 Fraud Liability Guarantee, keeping you protected from unauthorized charges

If you’re looking for a low-cost credit card that prioritizes interest savings over rewards, this card is an excellent choice.

Benefits Breakdown

| Feature | Details |

|---|---|

| Intro APR | 0% for 18 billing cycles on purchases & balance transfers |

| Regular APR | Variable APR based on creditworthiness |

| Annual Fee | $0 |

| Penalty APR | None |

| Balance Transfer Fee | 3% of each transfer (minimum $10) |

| Fraud Protection | $0 Liability Guarantee |

| Credit Score Access | Free FICO® Score |

NO PENALTY APR FOR LATE PAYMENTS

Unlike many other credit cards, the BankAmericard® does not impose a penalty APR if you miss a payment. This feature helps protect you from extreme interest rate hikes due to occasional financial missteps.

How to Improve Your Credit Score to Get Approved for the bankamericard® credit CARd

The BankAmericard® typically requires a good to excellent credit score (700+). If you’re planning to apply, consider these steps to improve your chances of approval:

- Make all credit card and loan payments on time, as payment history is the biggest factor in your credit score

- Keep credit utilization low, ideally below 30% of your total credit limit

- Check your credit report for errors and dispute any inaccuracies

- Avoid applying for multiple credit cards in a short period to minimize hard inquiries

- Increase your existing credit limits to improve your credit utilization ratio

Following these steps can boost your approval odds and help you qualify for lower interest rates.

FINAL CONSIDERATIONS

The BankAmericard® Credit Card is a smart financial tool for those looking to minimize interest payments and manage debt efficiently. With no annual fee, a long 0% intro APR period, and no penalty APR, it’s one of the best low-interest credit cards on the market.

For individuals looking to pay down existing credit card debt, the balance transfer offer can provide significant savings. While it doesn’t offer cashback or travel rewards, its focus on low costs and financial stability makes it an excellent choice.

If your goal is to reduce interest expenses and maintain financial flexibility, the BankAmericard® is an ideal option.

If you’re looking for a credit card that combines exceptional rewards, valuable travel perks, and strong purchase protections, the American Express® Gold Card is a top contender. Whether you’re enjoying fine dining, grocery shopping, or planning your next trip, this card provides one of the highest rewards rates in its category, making it an excellent choice for those who want to maximize their spending power and get rewarded for everyday expenses.