Anúncios

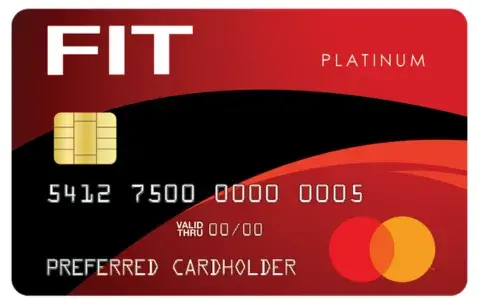

The MasterCad Fit Platinum is a fee-free card designed to boost your financial health and reward your active lifestyle, perfect for building credit and managing expenses.

Disclaimer: You will be redirected to the official website.

Benefits of MasterCad Fit Platinum

- No credit check required for approval.

- No annual fees, late fees, or interest charges.

- Reports payments to all three major credit bureaus, helping build or improve credit.

- Flexible spending limits based on your financial profile.

- Exclusive rewards for fitness and wellness-related purchases.

- Automatic payment options to ensure on-time payments.

Watch the Video

Pros

- Easy approval process without a credit check.

- Fee-free structure with no hidden costs.

- Helps improve credit score by reporting on-time payments.

- Tailored rewards for fitness and wellness enthusiasts.

- Ideal for those with limited or damaged credit history.

Cons

- Requires a MasterCad spending account to apply.

- Spending limit depends on your financial profile.

- Rewards are limited to specific categories.

about the card

The MasterCad Fit Platinum is more than just a credit card—it’s a financial tool designed to support your credit-building journey while rewarding your healthy lifestyle. With no credit check required, this card is accessible to nearly everyone, regardless of past financial challenges.

Unlike traditional credit cards, the MasterCad Fit Platinum does not offer a traditional credit line. Instead, users set their spending limits based on their financial profile, ensuring responsible spending and preventing debt accumulation. The card’s automatic payment feature ensures that payments are always made on time, a crucial factor for building a positive credit history.

By reporting to all three major credit bureaus, the MasterCad Fit Platinum helps users improve their credit score steadily and effectively. With no fees or interest charges, this card removes many of the financial barriers often associated with credit cards. Whether you’re a fitness enthusiast, a young professional, or someone rebuilding their credit, the MasterCad Fit Platinum offers a practical and supportive solution for improving your financial health.

How to Apply for the MasterCad Fit Platinum

Applying for this card is simple and straightforward.

- Eligibility Requirements: Applicants must be at least 18 years old, a U.S. resident, and have an active MasterCad spending account.

- Application Process: Download the MasterCad app or visit the MasterCad website, complete the application form with your personal and financial information, and link your spending account for verification.

- Funding the Card: Set your spending limit based on your financial profile, and your card will be ready for use.

Disclaimer: You will be redirected to the official website.

A Convenient Tool for Credit Building

The MasterCad Fit Platinum stands out for its ability to help users build credit responsibly while rewarding healthy lifestyle choices. By tying spending limits to your financial profile, users can maintain low credit utilization—a key factor in improving credit scores—while enjoying exclusive rewards for fitness and wellness-related purchases.

Benefits Breakdown

| Feature | Details |

|---|---|

| Annual Fee | $0 |

| Credit Check | Not required |

| Spending Limit | User-defined based on financial profile |

| Credit Reporting | Reports to all three major bureaus |

| Late Fees | None |

| Interest Rate | None |

| Automatic Payments | Available to ensure on-time payments |

| Rewards | Fitness and wellness-related purchases |

Accessible and Transparent Credit Building

The MasterCad Fit Platinum is designed to remove traditional barriers to credit. Its fee-free model, user-friendly features, and tailored rewards make it an accessible option for anyone looking to establish or rebuild their credit history while enjoying lifestyle benefits.

How to Improve Your Credit Score to Get Approved for MasterCad Fit Platinum

Building credit with the MasterCad Fit Platinum is straightforward, but adopting healthy financial habits is crucial for long-term success.

- Pay on Time: Timely payments are the most important factor in your credit score. Automate payments to ensure you never miss a due date.

- Monitor Utilization: Keep your spending within 30% of your limit to maintain low credit utilization.

- Track Your Progress: Regularly review your credit score through the MasterCad app and adjust your financial habits as needed.

- Check Your Credit Reports: Look for any errors in your credit reports and dispute inaccuracies that could harm your score.

Using the MasterCad Fit Platinum responsibly will help you establish a strong credit history and open the door to better financial opportunities.

FINAL CONSIDERATIONS

The MasterCad Fit Platinum is an excellent choice for individuals looking to establish or improve their credit while enjoying rewards tailored to their lifestyle. Its fee-free structure, automatic payment features, and reporting to major credit bureaus make it an effective tool for credit building.

Unlike conventional cards, the MasterCad Fit Platinum ties spending limits to your financial profile, encouraging responsible financial behavior. It is particularly well-suited for fitness enthusiasts, young professionals, and those recovering from financial setbacks.

While its rewards are limited to specific categories and it requires a MasterCad spending account, its simplicity and focus on credit building outweigh these limitations for most users. By leveraging the card’s features and adopting healthy financial habits, users can confidently work toward their credit goals and a more secure financial future.