Anúncios

Navigate the complexities of deductibles and copays to make informed choices about your health insurance plan and manage healthcare expenses with ease.

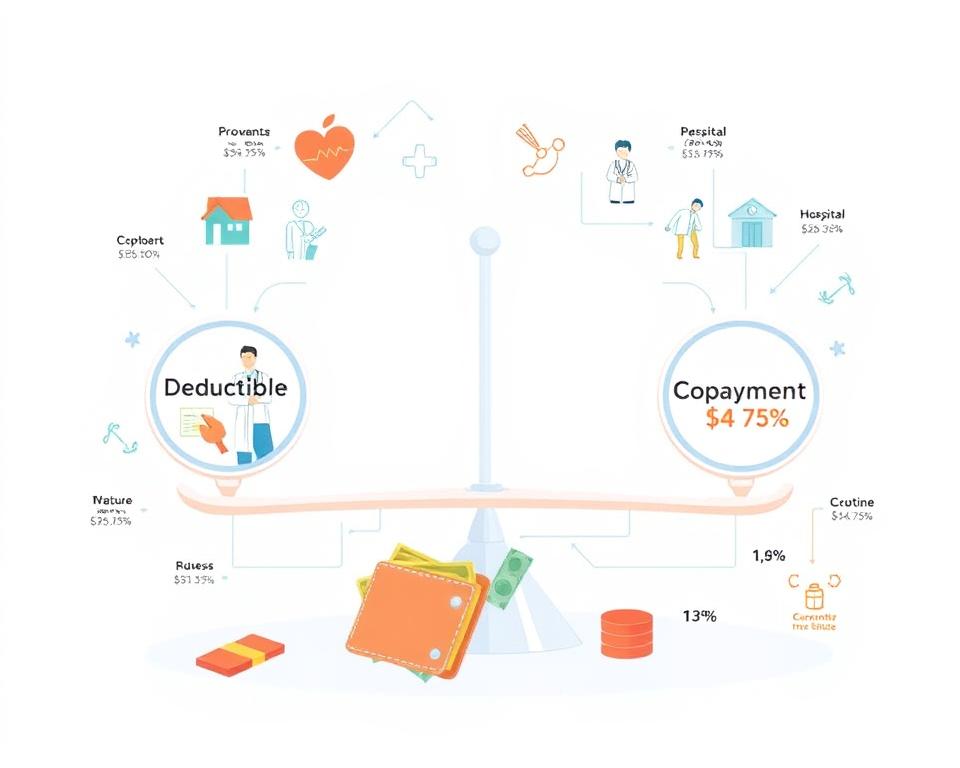

In the world of health insurance, deductibles and copayments are key. They affect how much you pay for healthcare. Knowing about them helps you plan your healthcare budget better.

These terms shape how you pay for medical services. They are important for managing your health insurance. Understanding deductibles and copayments helps you make smart choices about your health care.

Key Takeaways

- Deductibles are the amounts you pay before insurance coverage kicks in.

- Copayments are fixed fees for specific medical services even after deductibles are met.

- Understanding these terms helps with budgeting for healthcare expenses.

- Out-of-pocket costs can vary significantly depending on the health insurance plan.

- Being informed about these elements aids in choosing the right health insurance coverage.

What Are Deductibles?

Understanding deductibles is key to managing healthcare costs. A deductible is the amount you pay out-of-pocket for healthcare before insurance kicks in. It’s like a barrier that you must cross before getting insurance help.

Definition of Deductibles

Deductibles are a financial commitment before you get health insurance benefits. The amount varies by insurance provider and plan. In the U.S., deductibles can range from a few hundred to several thousand dollars.

How Deductibles Work in Health Insurance

Deductibles are a core part of most health plans. Before insurance pays, you must cover your deductible. For instance, if your deductible is $1,000, you pay that first. Then, the insurer covers your costs.

This setup affects your healthcare costs and how you plan for them. Deciding between high and low deductibles depends on your finances and health needs. Knowing this is essential.

Understanding Copayments

Knowing about copayments is key to managing healthcare costs. A copayment, or copay, is a fixed amount you pay for certain healthcare services. It’s usually paid at the time of service. This helps you know the cost of visits to doctors or pharmacies ahead of time.

Definition of Copayments

The term copayments is a big part of health plans. The amount you pay can change based on the service. For instance, you might pay more for a specialist than for a regular doctor.

When Copayments Apply

Copays are used in many situations, including:

- Doctor visits for primary care or specialty care

- Prescription medications at the pharmacy

- Emergency room visits

Knowing when you have to pay copayments helps you manage your money better. It’s important to know the difference between copayments and deductibles. Deductibles are paid before insurance starts, but copayments are paid at the time of service. This helps you make better choices about your healthcare.

| Service Type | Typical Copayment |

|---|---|

| Primary Care Visit | $20 |

| Specialist Visit | $40 |

| Emergency Room Visit | $150 |

| Prescription (Generic) | $10 |

| Prescription (Brand Name) | $30 |

How Deductibles Affect Out-of-Pocket Costs

It’s important to know how deductibles impact your out-of-pocket costs. Deductibles are a big part of figuring out your healthcare expenses. They decide when and how much your insurance will cover. This means you might have to pay more upfront for some patients.

The Role of Deductibles in Healthcare Expenses

Deductibles are key in determining your total costs. You pay all your medical bills until you hit your deductible. This amount can change based on your health plan, affecting how much you pay.

Calculating Out-of-Pocket Costs

Figuring out your total costs isn’t just about the deductible. You also need to think about copayments and coinsurance. These add to your costs after you’ve met your deductible. Here are some things to consider:

- Annual deductible: The amount you must pay before insurance starts covering expenses.

- Copayments: Fixed contributions you pay for specific healthcare services or medications after your deductible is met.

- Coinsurance: The percentage of costs you pay for healthcare services after reaching your deductible.

- Maximum out-of-pocket limit: The highest amount you will need to pay in a given year before insurance covers 100% of costs.

| Cost Component | Impact on Out-of-Pocket Costs |

|---|---|

| Annual Deductible | Must be met before coverage starts. |

| Copayment | Fixed charge for certain services. |

| Coinsurance | Percentage you pay post-deductible. |

| Maximum Out-of-Pocket | Annual cap on total spending. |

By looking at these factors, you can make better choices about your healthcare. This helps you keep costs down and understand how deductibles affect your spending.

Health Insurance Premiums and Their Relationship to Deductibles

Understanding how health insurance premiums and deductibles work together is key to managing healthcare costs. Premiums are the monthly payments for coverage. Knowing how deductibles affect these costs is crucial when picking a plan.

Understanding Health Insurance Premiums

Premiums change based on age, health, and plan type. High deductible plans cost less but require more upfront payment. Low deductible plans have higher premiums but lower costs per visit.

High Deductible Health Plans vs. Low Deductible Plans

When comparing high deductible plans to low deductible plans, consider these points:

- High Deductible Plans: They have lower premiums, appealing to the young and healthy. But, you pay more before insurance covers you.

- Low Deductible Plans: They cost more but have lower costs per visit. They’re good for those needing regular care.

Choosing between these plans depends on your health needs and budget. Look at both premium costs and deductibles to make a smart choice for you.

Coinsurance Rates Explained

It’s important to understand coinsurance to know your health insurance costs. Coinsurance is the part of medical bills you pay after your deductible is met. Knowing what is coinsurance helps you make smart choices about your healthcare spending.

What is Coinsurance?

Coinsurance is a way health insurance plans share costs. After your deductible, you and your insurer split the costs of medical services. For example, if it’s 20%, you pay 20% and your insurer pays 80%. This balance helps manage healthcare costs.

How Coinsurance Works with Deductibles and Copays

Coinsurance works with deductibles and copays in health plans. First, you meet your deductible. Then, coinsurance kicks in. For instance, if your deductible is $1,000 and your bill is $5,000, you pay coinsurance after that.

Here’s an example:

| Medical Expense | Deductible Paid | Coinsurance Rate | Your Out-of-Pocket Cost |

|---|---|---|---|

| $5,000 | $1,000 | 20% | $800 |

| Total | Paid | Total Expenses | $1,800 |

This shows how coinsurance with deductibles works. It helps you manage your healthcare costs. Knowing this helps you plan better for health expenses.

Maximum Out-of-Pocket Limits in Health Insurance

It’s important to understand the financial side of health insurance. The maximum out-of-pocket limits are a key part. They help protect against high medical costs throughout the year. Knowing these limits helps people plan their finances better while taking care of their health.

Understanding Maximum Out-of-Pocket Limits

The maximum out-of-pocket limit is the highest amount you pay for healthcare in a year. After reaching this limit, your insurance covers all costs for the rest of the year. This is very helpful when medical bills can rise fast. Knowing these limits helps you plan your costs and avoid surprises.

The Importance of Maximum Limits for Budgeting Healthcare Costs

Maximum out-of-pocket limits are crucial for planning your healthcare budget. They help you predict your medical expenses. Here are some benefits:

- Predictable Costs: Knowing the limits helps avoid sudden financial burdens.

- Enhanced Financial Planning: They help you manage healthcare expenses better.

- Peace of Mind: They reduce worry about unexpected medical bills, especially in emergencies.

Using maximum out-of-pocket limits is key to good healthcare budgeting. By knowing these limits, you can protect your finances while getting the medical care you need.

Cost-Sharing Responsibilities in Health Insurance Plans

In health insurance, cost-sharing means the costs that both you and your insurer pay. This includes things like deductibles, copayments, and coinsurance. Knowing about cost-sharing is key for managing your healthcare costs.

What is Cost-Sharing?

Cost-sharing splits the cost of healthcare between you and your insurance company. These costs can affect how much care you can get and your treatment choices. Learning about cost-sharing helps you handle your financial part in healthcare.

How Cost-Sharing Affects Your Overall Costs

Cost-sharing models can change your healthcare costs. For example, higher deductibles might mean lower premiums but more upfront costs. Knowing how these work helps you choose better health coverage. Things like in-network vs. out-of-network services also play a role. For more info, check out

Factors Influencing Deductible Amounts

Understanding the factors influencing deductibles is key to smart health insurance choices. These factors differ among people and plans, affecting what you pay. Knowing these can help you manage healthcare costs better.

Common Factors Affecting Deductibles

Several important things affect deductible amounts in health insurance:

- Age: Younger people usually have lower premiums and deductibles than older ones, due to health needs.

- Health Status: Those with pre-existing conditions might have higher deductibles because insurers see them as riskier.

- Insurance Plan Type: Different plans like HMOs or PPOs have different deductible setups.

- Geographical Location: Healthcare costs vary by location, so deductibles can differ for people in different places.

Choosing the Right Deductible for You

When picking a deductible, think about your health needs and money situation. Here are some deductible considerations:

- Look at how much healthcare you might need in a year to guess your costs.

- Check your finances. A higher deductible might mean lower premiums, but make sure you can handle the extra cost if needed.

- Consider how much risk you’re willing to take. Healthy people might choose higher deductibles to save money, while those with health issues might prefer lower ones.

Saving for Healthcare Expenses with Health Savings Accounts

Health Savings Accounts (HSAs) are great for managing healthcare costs. They let you save for medical expenses and offer tax benefits. HSAs are especially useful for those with high deductible health plans.

What is a Health Savings Account (HSA)?

An HSA is a special savings account for medical costs. You need a high deductible health plan to get one. Contributions are tax-deductible, and the money grows tax-free. This makes HSAs a good choice for saving for healthcare in the long run.

Benefits of Using HSAs for Deductibles and Copays

HSAs offer more than just tax benefits. They give you control over your healthcare spending. Here are some key benefits:

- Tax Savings: Contributions to HSAs are tax-deductible, reducing taxable income.

- Tax-Free Growth: Funds in the account grow tax-free, maximizing savings for healthcare.

- Qualified Medical Expenses: HSAs can cover a range of expenses, including deductibles and copayments.

- Portability: They remain with the account holder, even if employment changes or plans change.

Using health savings accounts helps with budgeting for healthcare. It also encourages smart financial planning. By choosing wisely how much to contribute and where to invest, you can create a strong financial safety net for future medical costs. This improves your overall healthcare experience.

| Feature | Health Savings Accounts (HSAs) | Flexible Spending Accounts (FSAs) |

|---|---|---|

| Tax Deductible Contributions | Yes | Yes |

| Tax-Free Growth | Yes | No |

| Rollover of Unused Funds | Yes | No |

| Eligible for Investment | Yes | No |

Conclusion

In this article, we covered deductibles and copayments, key parts of health insurance costs. Knowing how they work helps you plan your finances better. It also helps when picking an insurance plan.

A good grasp of deductibles lets you predict costs. This way, you can pick a plan that fits your health needs and budget.

We also talked about copayments and how they affect your healthcare spending. Other factors like coinsurance and out-of-pocket limits also play a role. Being informed helps you choose the right insurance for you.

Understanding these concepts well can help you manage healthcare costs better. For more details, check out this resource. It goes into more depth about deductibles and can guide you in choosing the best health insurance plan.

Read more: What You Need to Know About Disability Insurance

FAQ

What are deductibles in health insurance?

Deductibles are the amount you must pay for healthcare before your insurance kicks in. Knowing this helps you plan your costs better.

How do copayments work in health insurance?

Copayments, or copays, are fixed costs for services like doctor visits or prescriptions. You pay them even before your deductible is met.

What is the relationship between health insurance premiums and deductibles?

Higher deductibles often mean lower premiums. This trade-off lets you pick a plan that fits your budget.

How does coinsurance relate to deductibles and copays?

Coinsurance is a percentage of costs after your deductible is met. It works with deductibles and copays to share costs in your plan.

What are maximum out-of-pocket limits in health insurance?

Maximum out-of-pocket limits set a yearly cap on your costs for covered services. This protects you from very high medical bills.

What does cost-sharing mean in health insurance?

Cost-sharing divides healthcare costs between you and your insurance. It includes deductibles, copays, and coinsurance. Understanding this helps you know your costs.

What factors influence the amounts of deductibles?

Deductible amounts can vary based on age, health, plan type, and location. Knowing these factors helps you choose the best plan for you.

How can I save for healthcare expenses using Health Savings Accounts (HSAs)?

Health Savings Accounts (HSAs) let you save tax-free for healthcare, including deductibles and copays. They’re great for high-deductible plans.

Are there any differences between high-deductible health plans and low-deductible plans?

Yes, high-deductible plans have lower premiums but higher upfront costs. Low-deductible plans have higher premiums but lower costs at first. Your choice depends on your health needs.